Avoiding the sting of PFIC classification

For most, a PFIC is not necessarily a good thing.

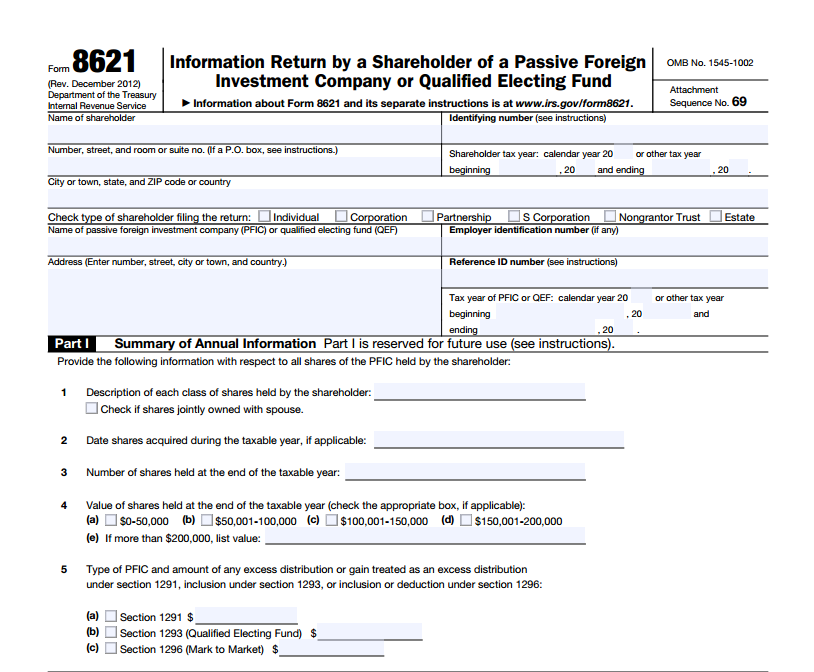

PFICs are subject to complicated and strict tax guidelines by the Internal Revenue Service (IRS), which covers treatment of these investments in Sections 1291 through 1297 of the income tax code. Both the PFIC and the shareholder must keep accurate records of all transactions, including share basis, dividends and any undistributed income earned by the company. The strict guidelines are set up to discourage ownership of PFICs by U.S. investors.

For some US persons with passive overseas investments, there are other structures to consider. One option is establishing a controlled foreign corporation (CFC), using form 5471 as usual and treating earnings as subpart F income. Now by treating CFC’s earnings as subpart F, they may not be subject to the PFIC regime pursuant to the overlap rule.

For more details, have a look at the private letter ruling (PLR) which I quote from below – Index Number: 1297.00-00, 957.00-00

Code section 1297(d)(1) provides that a corporation shall not be treated with respect to a shareholder as a PFIC during the qualified portion of such shareholder’s holding period with respect to the stock in such corporation. (“Overlap Rule”).

The legislative history to Code section 1297(d) provides that the Overlap Rule was enacted because of a concern about the unnecessary complexity caused by the application of the subpart F and PFIC regimes to the same shareholders. To address this concern, the legislative history to Code section 1297(d) states that “a shareholder that is subject to current inclusion under the subpart F rules with respect to stock of a PFIC that is also a CFC generally is not subject also to the PFIC provisions with respect to the same stock.”

Recent Posts